Revenue is the total amount of money earned from sales of a product while profit is the revenue that’s remaining after all expenses and costs of running the business are subtracted from revenue. The contribution margin is determined by subtracting the variable costs from the price of a product. Since that would require extensive analysis, we have just used sales revenue as a proxy and divided it by a total number of units to derive the price per unit. The gross sales for 2018 were $133,045MM, which, when divided by 8,384,000, gives a price per unit of $15,869. Let us take the case of a multiproduct company producing three different kinds of products named A, B, and C and try to find the breakeven number of units. The following table gives a breakdown of the price, variable costs, and the expected number of units to be sold and let us assume the fixed cost to be $6,600.

Contractor Calculators

In other words, your company is neither making money nor losing it. Using the break-even point formula above we plug in the numbers ($10,000 in fixed costs / $120 in contribution margin). Sometimes companies want to analyze the total revenue and sales needed to cover the total costs involved in running the company. At this point, you need to ask yourself whether your current plan is realistic or whether you need to raise prices, find a way to cut costs, or both. You should also consider whether your products will be successful on the market.

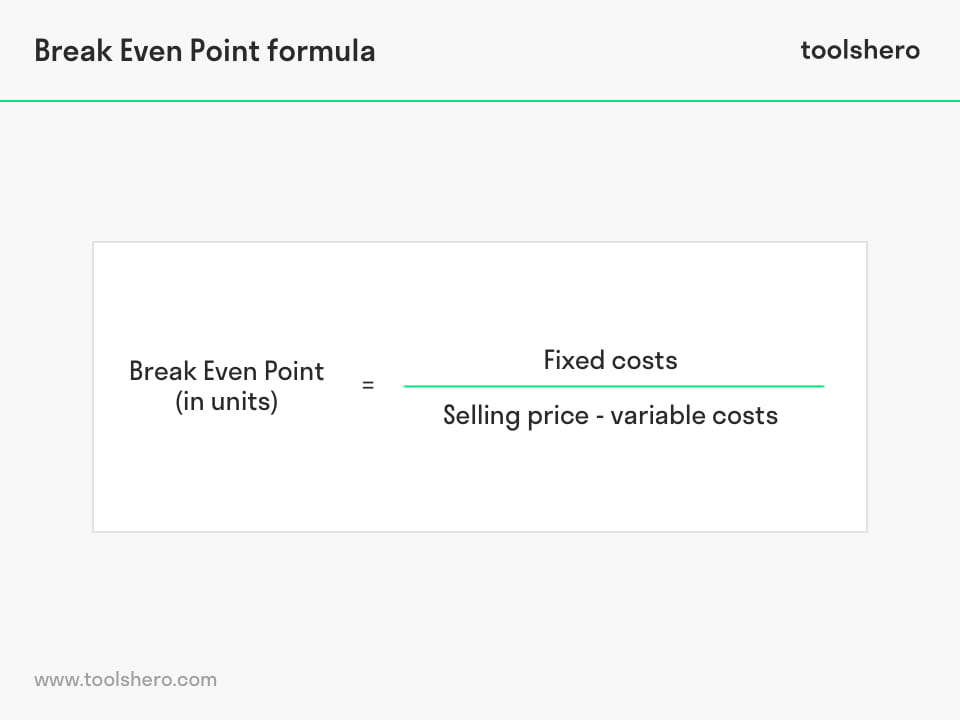

Calculating the break-even point in number of units

So to break even, Maria needs to create and sell eight quilts a month. If she wants to turn a profit, she’ll need to sell at least nine quilts a month. It’s the tipping point where you’re no longer losing money, but are not yet making a profit. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

What is your current financial priority?

- Central to the break-even analysis is the concept of the break-even point (BEP).

- Break-even price calculations can look different depending on the specific industry or scenario.

- It’s the tipping point where you’re no longer losing money, but are not yet making a profit.

- Your break-even analysis alone won’t factor in the increased rent, higher utility bills, or additional staff wages.

Businesses share the similar core objective of eventually becoming profitable in order to continue operating. Otherwise, the business will need to wind-down since the current business model is not sustainable. If you’re having trouble hitting your break-even point or it seems unreachable, it’s time to make a change.

How to calculate break-even point

Conversely, it can also help you determine how many costs you need to cut to reach profitability. Out of the several ways to measure your business’s profitability, calculating the break-even point is one of the most simplistic. The break-even point for sales is 83.33 or 84 units, which need to be sold before the company covers their fixed costs. From that point on, or 85 units and beyond, the company will have paid for their fixed costs and record a profit per unit. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized.

Free Course: Understanding Financial Statements

The put position’s breakeven price is $180 minus the $4 premium, or $176. If the stock is trading above that price, then the benefit of the option has not exceeded its cost. Assume that an investor pays a $5 premium for an Apple stock (AAPL) call option with a $170 strike price. This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost.

The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume. Note that in the prior example, the fixed costs are “paid for” by the contribution margin. The more profit a company makes on its units, the the operations management insight blog fewer it needs to sell to break even. This formula helps you determine the total revenue required to cover your operating expenses, based on your business’s gross margin. One limitation of break-even analysis is that it assumes selling prices will stay the same over time.

Notice in the first two formulas, we know the sales price and are essentially deriving quantity sold to break even. But in this case, we need to estimate both the number of units sold (or total quantity sold) and relate that as a function of the sales price we solve for. We can also see the number of units to be sold for General Motors to breakeven has increased in 2018, which may be due to the increase in variable cost per unit. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300).

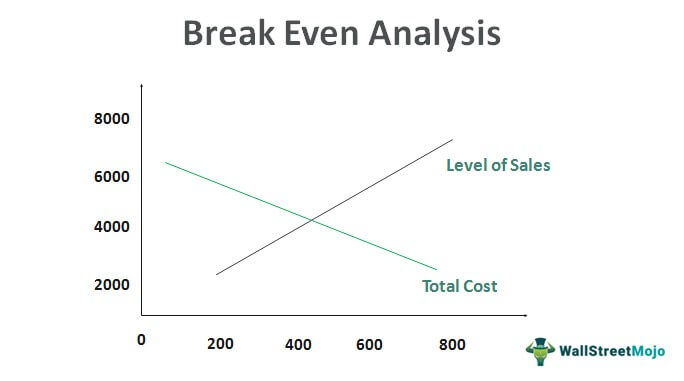

The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. To calculate the break-even analysis, we divide the total fixed costs by the contribution margin for each unit sold. Using the earlier example, let’s say that the total fixed costs are $10,000. Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times.

Where the contribution margin ratio is equal to the contribution margin divided by the revenue. The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time. It might be a good idea to come back to this break-even calculator after you actually start doing business. Often times you will find the need to adjust your costs and factor in things you overlooked before. As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k.

That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures.